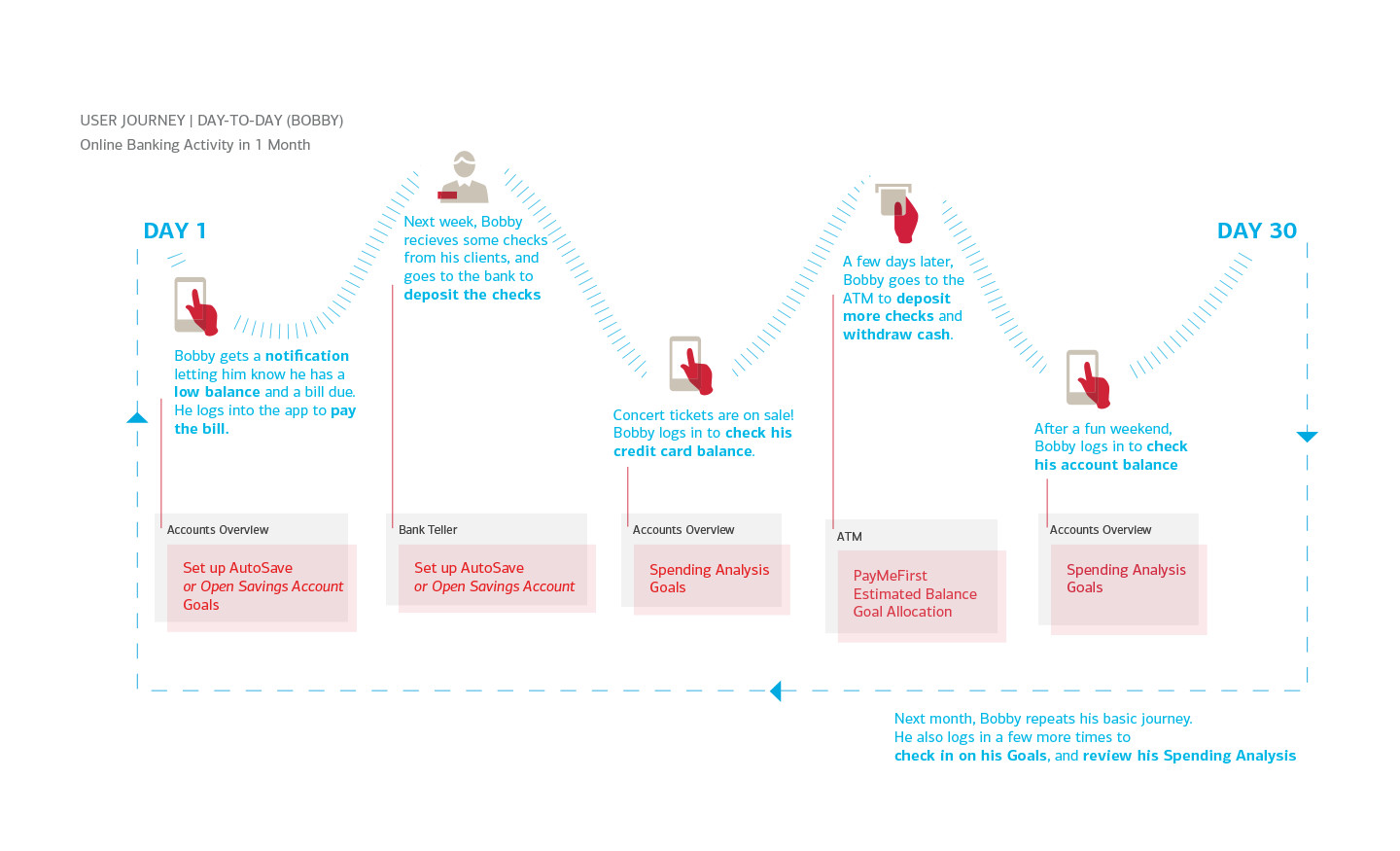

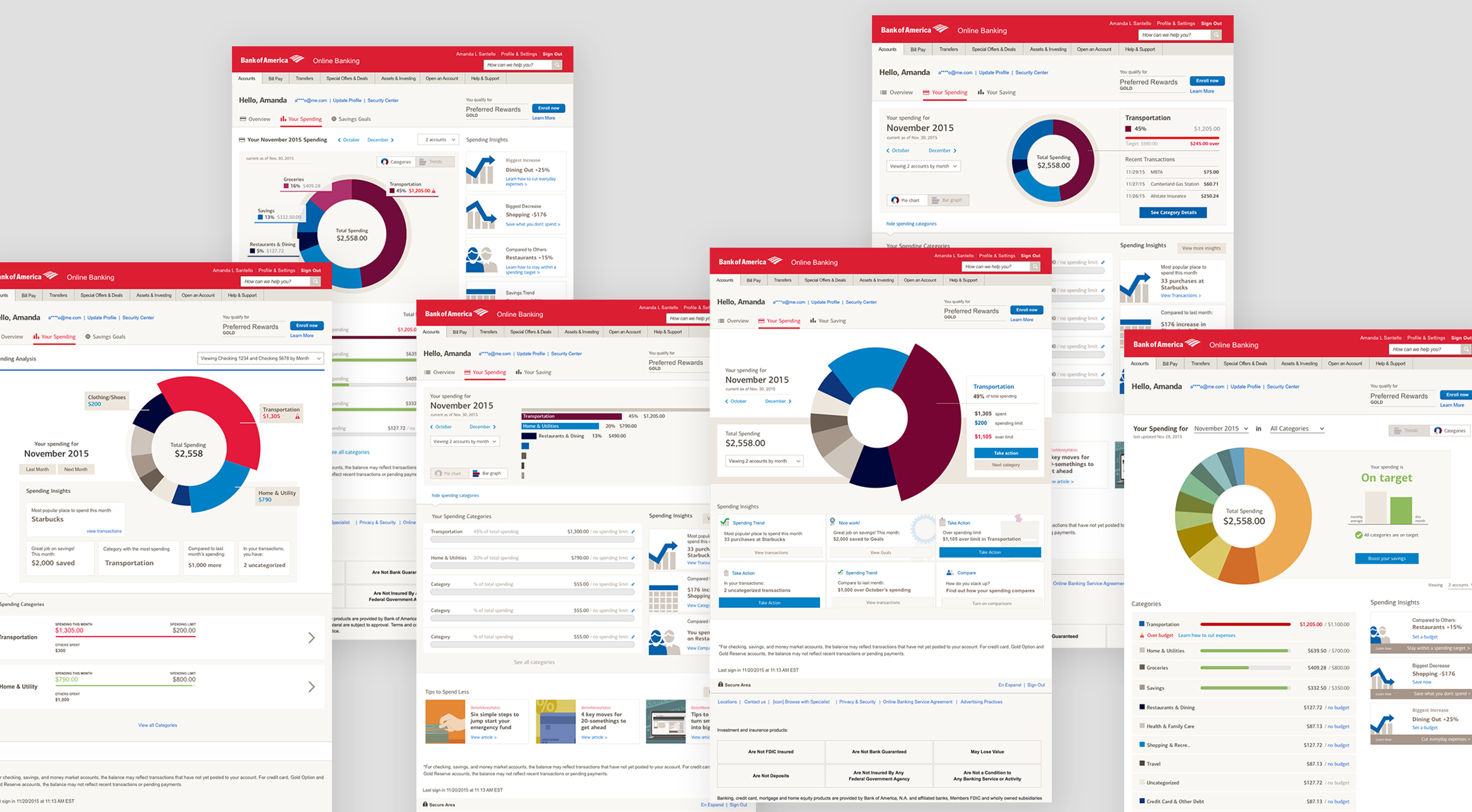

Bank of America wanted to create budgeting tools to help its customers understand their spending habits and find ways to make better financial decisions day-to-day.

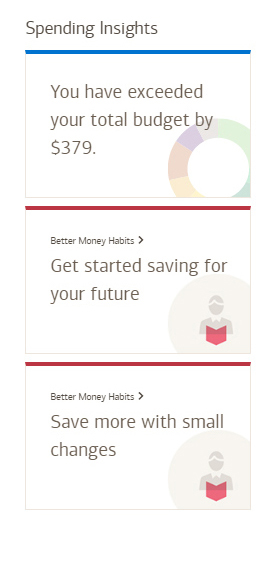

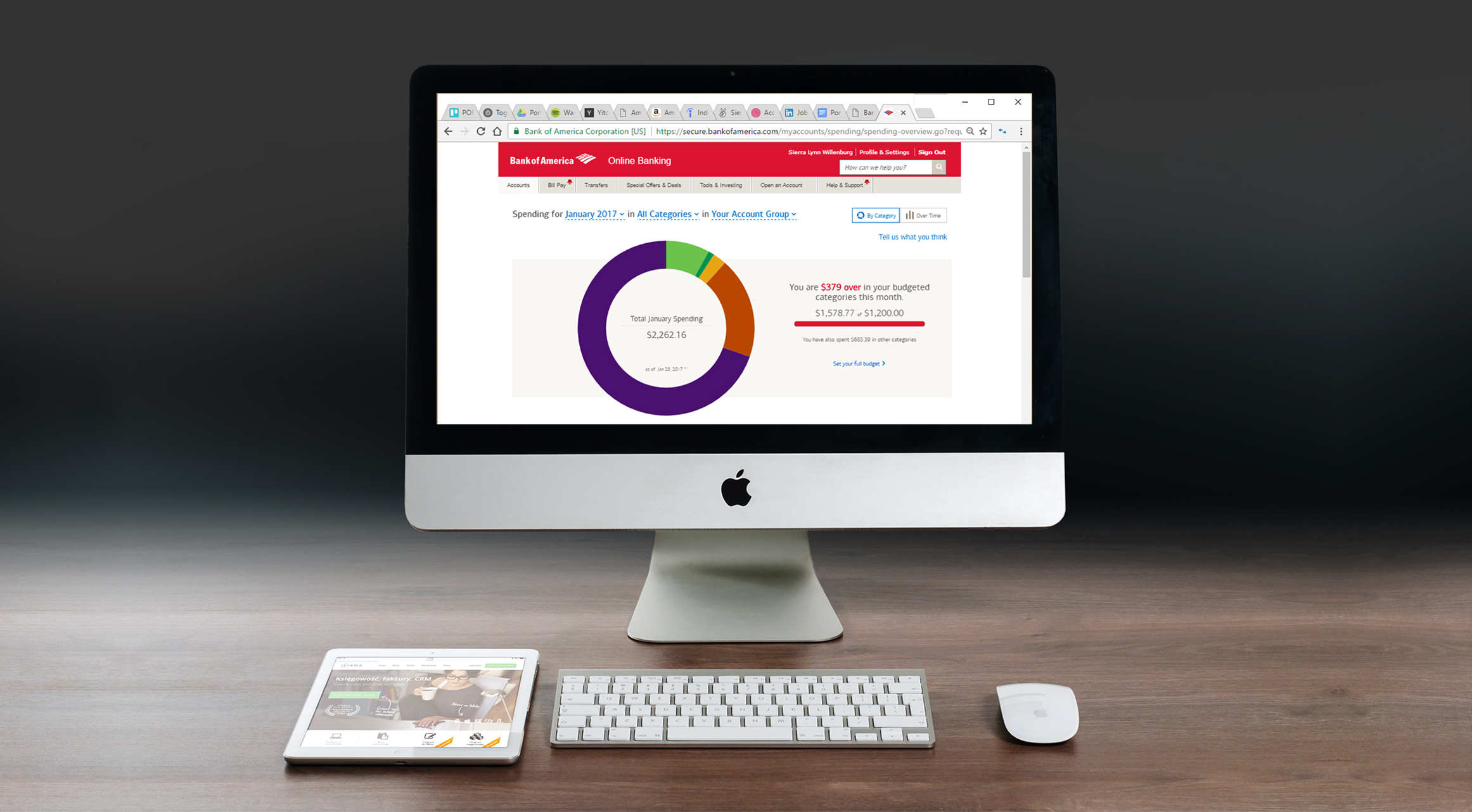

Most people want to spend less, but figuring out where to start saving can be a challenge. Bank of America provides its customers with spending analysis and budgeting tools, right in their online account.

These tools let you see what categories you’re spending on, and helps find ways to cut costs. Most importantly, information is presented in an understandable, human way.